Effective June 1, 2025, the Power Supply Adjustment (PSA) is a $0.002 per kWh credit.

Since 2005, the Power Supply Adjustment (PSA) has been a charge or credit applied to customer bills based on kWh energy usage. The PSA is used to offset the variances that occur over time between the base rate and actual power supply costs. It can vary between a one-cent per kWh charge and a half-cent per kWh credit.

The PSA is intended to vary and account for changes in power supply costs. It is not an increase in our base rates. Unlike a base rate increase, the PSA is not fixed and will be adjusted down, should power supply costs decrease

The PSA is used to offset the variances that occur over time between the base rate and actual power supply costs. It can vary between a one-cent per kWh charge and a half-cent per kWh credit. The PSA is reviewed and can be adjusted twice a year to be effective on June 1st and December 1st. In December 2022 the PSA moved to a half-cent charge due to extremely high natural gas prices, moved back to a half-cent credit in June 2024, and moved to zero on January 1, 2025. It is currently set to a $0.002 per kWh credit.

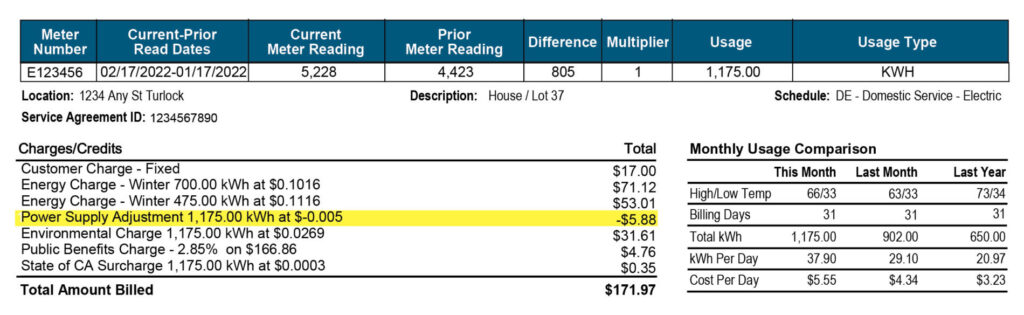

The PSA is intended to vary and account for changes in power supply costs. It is not an increase in our base rates. Unlike a base rate increase, the PSA is not fixed and will be adjusted down, should power supply costs decrease. You can find the Power Supply Adjustment line on your bill as shown below.

Customers had received a $0.005 per kWh credit from 2012 to 2022, which changed to a $0.005 per kWh charge in December 2022, then returned to a $0.005 per kWh credit in June 2024, then moved to zero in January 2025. It is currently set to a $0.002 per kWh credit.

Example of where on your bill the Power Supply Adjustment can be found.

The PSA is a per kWh charge or credit, which takes into account variances in the District’s net power supply cost compared to the amount that is in the base rates. The power supply costs include such items as purchased electricity and fuel. When calculated, the PSA charge or credit takes into account the previous 6 months power supply expenses and the forward 12 month projection of power supply costs. When those calculations show an increase, the PSA can increase, when they show a decrease, the PSA can decrease. However, the PSA cannot go above one-cent per kWh charge or below a half-cent per kWh credit, regardless of the change in power supply costs. The PSA is reviewed and can be adjusted twice a year to be effective on June 1 and December 1.

The PSA was adopted in December 2004 and historically has changed on the following dates.

The PSA is reviewed twice a year and takes into account the previous 6 months power supply expenses and the forward 12 month projection of power supply costs. When those calculations show an increase, the PSA can increase, when they show a decrease, the PSA can decrease.

Go to My.TID.org to log into My TID. Here you can track your usage by kWh or by amount spent on energy daily, weekly or each month. You can also compare your current spending and usage to the same time frame last year.

TID strives to help all customers facing challenges managing their energy costs, with a number of assistance programs to make bill payment and budgeting easier. Customers can contact Customer Service at (209) 883-8222 or visit TID.org to inquire about these programs and possible payment arrangements.

TID has programs available to assist customers in paying their electric bills.

Customer Charge: This is a fixed cost based on costs for metering, billing, collection, and related costs.

Energy Charge – The cost of energy based on the amount of electricity consumed each month, in addition to the costs of operating and maintaining the electrical transmission and distribution system, as well as virtually every business service related to providing and planning electric delivery functions.

Public Benefits Charge – Mandated by the State of California to fund renewable resources, energy efficiency programs, low-income assistance and energy research and development projects. The rate is 2.85% of the amount billed.

State Surcharge – A utility tax collected and administered by the State of California.